What legal form is appropriate for your enterprise?

As a natural person or a company

To begin with, make the choice of legal form under which your self-employed activity will be exercised. You can exercise your self-employed activity as a natural person or a company. Your accountant can help you in making this choice.

The table below shows you the main differences between these two forms of enterprise:

|

Natural person enterprise |

Legal entity enterprise = company |

|---|---|---|

Incorporation |

No writing articles of association |

The deed of incorporation:

|

Cost of incorporation |

Registration with the Crossroads Bank for Enterprises: €88.50 |

|

Capital to invest |

No minimum capital required |

Minimum capital required according to the form of company chosen:

|

Liability |

No separation between private assets and professional assets |

Liability depends on the legal form chosen |

Natural Person

A sole proprietorship does not require writing articles of association or initial minimum capital. The costs of incorporation and functioning are low and the entrepreneur can quickly begin his/her activity. He/she is solely in control and can take the required decisions for exercising his/her activity without having to consult other shareholders. The accounts keeping is generally simplified. In the case of an enterprise in the form of a natural person, there is no separation between the assets assigned to the professional activity and the private assets of the entrepreneur. He/she is therefore, in full knowledge, responsible for the commitments of his/her enterprise. This is not without risk, for example, in case of the bankruptcy of an important client. His/her debts may be recovered against all assets of the entrepreneur, both movable property and real estate, present or future. The assets of the spouse may also have to be assigned to the payment of debts of the enterprise unless a matrimonial agreement specifies otherwise.

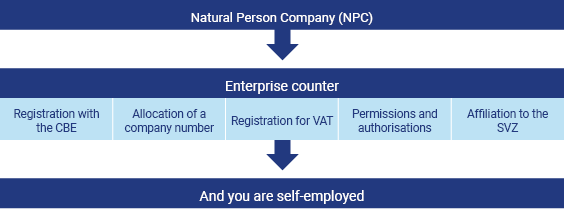

I get started as a natural person

You are tempted to begin as a natural person enterprise? The formalities are minimal and your privileged interlocutor is the approved one-stop-shop for enterprise registration. Just make contact with our employees at the Formalis one-stop-shop for enterprise registration.

Your interlocutor at the one-stop shop, after checking that you have access to the profession, will proceed with:

- your registration with the Crossroads Bank for Enterprise;

- the creation of your Commercial Enterprise number, which will reference all of the data relative to your activity;

- your affiliation to the Social-security fund for the self-employed

- the identification for VAT;

- the verification of the specific authorisations and/or licences necessary in the chosen sector of activity (SABAM, AFSCA,…).

And in the blink of an eye, you are self-employed!

Companies (legal entity)

- SRL/BV: limited-liability company

- SA/NV: public limited company

- SC/CV: cooperative company

- Ordinary partnership without legal personality

- SNC/VOF: general partnership (variant of an ordinary partnership but with legal personality)

- SComm/Comm.V.: limited partnership (variant of an ordinary partnership but with legal personality)

Limited-liability companies

- Can be established by one or more persons referred to as directors or shareholders

- Must be incorporated by means of an official deed

- Unless otherwise provided for in the deed of incorporation, all contributions must be fully paid up at the time of incorporation

- Has legal personality

- There is no longer any minimum capital requirement but:

o There must be a detailed financial plan

o The founders must provide enough capital from their own pocket to keep the business going

Public limited companies

- Can be established by one or more persons (natural person enterprise or legal entity enterprise)

- Must be incorporated by means of an official deed

- Has legal personality and can be listed on the stock exchange

- The minimum capital is still €61,500

- Must have a financial plan

- The right to vote may differ for each share but each share will have at least one vote attached to it

- Shareholders are only responsible for their own contribution

Cooperative companies

- Must be established by at least three founders

- Must be incorporated by means of an official deed

- Has legal personality

- There is no longer any minimum capital requirement but the founders must provide enough starting capital from their own pocket to keep the business going

- The main aim of cooperative companies must be to:

- Meet the needs of their shareholders, in particular by concluding agreements with them to supply goods or services or perform work relating to the cooperative company’s business

- Develop the economic and/or social activities of their shareholders

- Shares are freely transferable between members

- Members are only responsible for their own contribution

Ordinary partnerships

- By means of a declaration or agreement, two or more persons (designated representatives) agree to pool their contributions with a view to sharing any resulting financial gain.

- Unless the partnership agreement stipulates that they must act jointly, these representatives may separately perform the actions falling within their remit.

- They have no legal personality, except for the following two variants of the ordinary partnership: general partnerships and limited partnerships, which do have legal personality.

- The partners have unlimited liability except in the case of limited partnerships, where the limited partners are liable for their own contribution.

- Shares are non-transferable unless otherwise agreed.

- The partnership is concluded for an indefinite period unless otherwise stipulated in the agreement.

- In principle, the death of a partner results in the dissolution of the ordinary partnership unless the agreement provides for continuity through the heirs of the deceased partner or with the remaining partners only.

- Registration in the Crossroads Bank for Enterprises (CBE) is now required.

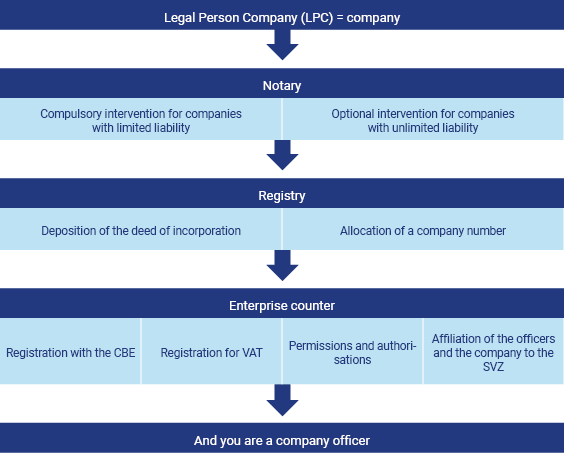

Create a company!

Would you prefer to work as a company? You first need to choose the legal form.

Generally, you must go through a notary to enact the deed of incorporation. Within 15 days of its signature, this must be registered with the Commercial Court Registry.

At that precise moment, the company acquires the legal personality, becomes binding on third parties and obtains its commercial enterprise number.

As this number still has no commercial or non-commercial capacity, you must go to a one-stop-shop for enterprise registration in order to :

- include in this all the codes for your activity;

- proceed with identification for VAT;

- check the specific authorisations and/or licences necessary for the exercise of the activity;

- affiliate yourself personally, and the company, with the Social-security fund for the self-employed.